Presently, with the fast digital environment, the business world is changing fast. Artificial Intelligence, or AI, has been one of the biggest innovation providers in the industry revolution. Once confined in its narrow scope, AI is now being used to transform many industries, especially bookkeeping and financial management.

What is AI Bookkeeping?

AI bookkeeping basically entails the use of artificial intelligence technologies to automate traditional bookkeeping processes and enhance them. It basically involves the application of machine learning algorithms, natural language processing, and other AI-driven tools to manage financial transactions, invoices, tax filings, and much more with minimal human involvement.

Why AI Bookkeeping is Growing in Popularity

Bookkeeping under manual records suffers in errors at the entry point, calculation, or even both. AI on the other hand can process large amounts of data with reasonably high accuracy so that errors are kept at a minimum. Consequently, the reports delivered are more dependable when it comes to the basis of actual decisions.

Cost Efficiency: AI would engage much less human labor in accounting. SMBs and start-ups could, easily scale down considerably the overheads by using AI solutions. They would not have to necessarily hire full-time bookkeepers or accounting teams.

Time Savings: AI systems are much faster than humans. This makes it quite possible to let AI systems simplify repetitive work such as categorizing transactions, preparing invoices, and automated payroll processing. It frees up a huge amount of time for strategic goals.

Real-time financial insights: AI bookkeeping solutions provide real-time analysis of data- P&L and balance sheets, of the business. Businesses now can track cash flow and monitor expenses that stay abreast of their financial health without waiting for month-end reports. Real-time insights are very important in making quick and informed decisions in business operations.

The AI bookkeeping solutions are scalable. That means they easily grow with your business. Whether you have a startup or a large enterprise, AI can handle your growing bookkeeping requirements without constantly asking you to upgrade and overhaul these frequently.

Important Features of AI Bookkeeping Tools

Automated data entry: AI books automatically capture data from receipts, bank statements, and invoices, thus simplifying the process of data entry.

Expense Categorization: Because AI learns from its history, it will categorize expenses effectively. The more a system learns, the more accurately it predicts and categorizes future transactions.

Fraud detection: AI software identifies suspicious patterns in a firm’s financial information, hence saving the company from committing fraud and errors.

Tax preparation: AI bookkeeping apps have features that are currently connected with tax preparation ones. They can generate tax reports and even file tax returns for a company if the financial data referring to them is correct and updated.

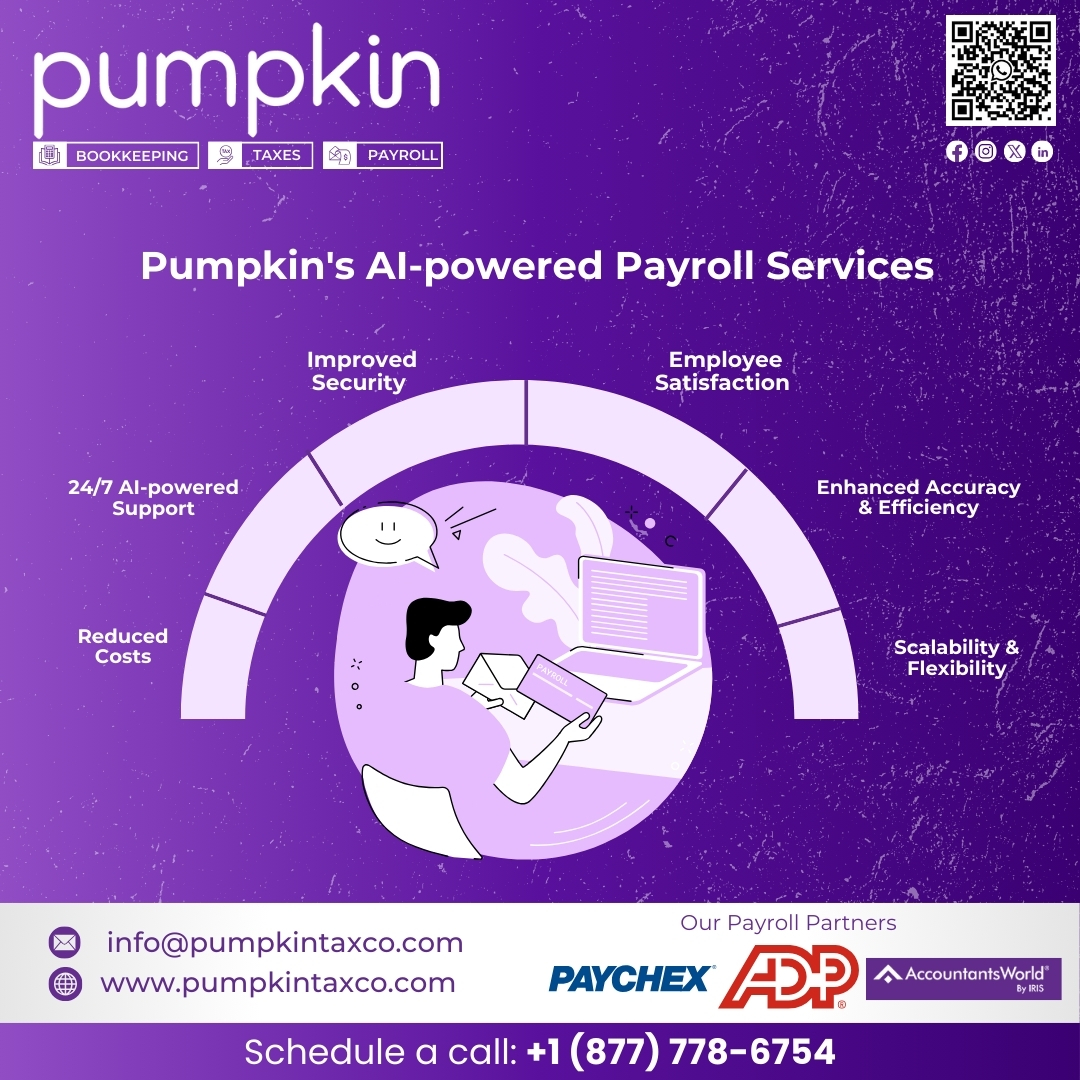

Payroll Automation: AI-based payroll functionalities automatically process payments, tax deductions, legal compliance, and so much more for your employees.

The Future of AI Bookkeeping

AI bookkeeping is no longer a trend-it’s the future of financial management. And in the future, we can expect much more advanced systems that would incorporate customization, predictive analytics, and integration with other business tools.

AI tool integration would include enhanced features such as blockchain for secure financial transactions, advanced fraud detection, and deeper analytics of how a business actually runs itself, giving users greater accuracy and insight into the respective businesses.

Challenges to Consider

Although AI bookkeeping has many benefits, there are some specific concerns that should be taken into account:

Data Security: Financial data is very sensitive, and businesses need to ensure their AI solutions are safe and abide by the data protection laws.

Cost of Implementation: Although AI bookkeeping saves long-run, the front cost for the adoption of these technologies will be a heavy burden on small-scale businesses.

Lack of Relegance to Technology: Over dependence on AI systems without human oversight may lead to missed opportunities or errors that only human intuition may spot.

Conclusion

AI bookkeeping changes the balance of what matters for a business when it comes to finance processing. Its capabilities fall into three categories: automation of repetitive, routine-based tasks; real-time insights into transactions; and avoiding errors in financial processing. In short, the future of financial management is in the hands of intelligent automated systems as firms open their doors to AI bookkeeping.

By embracing AI bookkeeping, your organization saves time and minimizes error rates while unlocking new financial insights that will help it drive growth and success in this digital age.