In an era dominated by digital transactions and fintech innovation, scalability has become one of the defining features of any successful eWallet system. As millions of users shift toward contactless and mobile-based payments, businesses are under constant pressure to deliver fast, secure, and seamless experiences. This is where cloud technology steps in—offering a flexible, cost-effective, and highly scalable foundation for eWallet app development. From supporting growing transaction volumes to enabling global reach, the cloud is reshaping how eWallet solutions are built and maintained.

The Role of Scalability in Modern eWallets

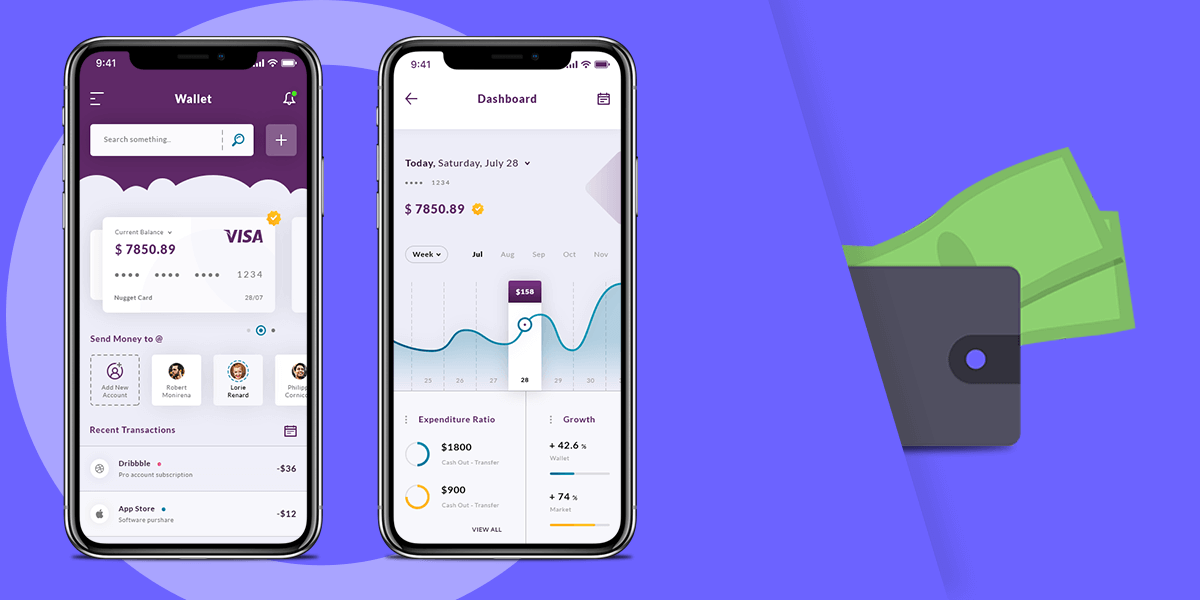

Scalability in an eWallet application refers to its ability to handle increasing workloads, users, and transactions without compromising on performance. Imagine an eWallet app that performs perfectly with 10,000 users but crashes when that number grows to a million—that’s a clear sign of limited scalability.

Cloud technology eliminates these constraints by providing on-demand computing resources that scale up or down as needed. Whether during peak transaction hours or festive seasons with high traffic, cloud-enabled eWallets can dynamically adjust capacity to maintain performance and reliability.

Why Cloud Infrastructure Is Essential for eWallet Scalability

-

On-Demand Resource Allocation

Cloud computing enables eWallet providers to scale resources instantly. For instance, if transaction volumes surge due to a promotional campaign or user growth, the cloud infrastructure automatically allocates additional servers and bandwidth to maintain performance. -

Global Accessibility and Distribution

eWallet apps need to be accessible from multiple regions. Cloud-based hosting uses Content Delivery Networks (CDNs) to ensure low-latency transactions, faster data transfers, and smooth user experiences—no matter where users are located. -

Reduced Infrastructure Costs

Traditional on-premise infrastructure requires heavy upfront investment and maintenance. In contrast, cloud technology follows a pay-as-you-go model, allowing businesses to pay only for the resources they use. This makes it ideal for startups and enterprises alike who seek cost-effective scalability. -

Real-Time Data Synchronization

eWallets rely on real-time updates for balance tracking, transaction status, and payment confirmations. Cloud environments allow seamless synchronization between multiple servers, ensuring all user data and transactions are updated instantly and securely. -

High Availability and Disaster Recovery

Cloud platforms provide redundancy and failover systems that guarantee uptime and resilience. Even if one data center fails, another takes over automatically—ensuring uninterrupted service for users worldwide.

Cloud Architecture Models for eWallet Development

When developing a scalable eWallet, choosing the right cloud architecture is crucial. Businesses can opt for:

-

Public Cloud: Ideal for startups seeking cost efficiency and fast deployment. Providers like AWS, Azure, and Google Cloud offer flexible solutions for eWallet scalability.

-

Private Cloud: Suitable for enterprises that prioritize strict security and compliance. It provides dedicated resources with enhanced data control.

-

Hybrid Cloud: A balanced approach combining public and private cloud capabilities—offering both flexibility and data protection.

Each model supports unique scalability needs depending on user base size, transaction frequency, and compliance requirements.

How Cloud Enhances eWallet Security While Scaling

Security and scalability go hand-in-hand in the fintech ecosystem. Cloud platforms come with advanced protection features like data encryption, firewalls, intrusion detection, and identity management systems. These features ensure that even as your eWallet grows, it remains compliant with financial regulations such as PCI DSS and GDPR.

Moreover, centralized security management allows for real-time monitoring and threat detection—essential in preventing cyberattacks or fraud attempts in large-scale deployments.

Benefits of Using Cloud Technology for eWallet Apps

-

Faster Deployment: Cloud infrastructure simplifies development and deployment, enabling eWallet apps to enter the market quickly.

-

Enhanced Collaboration: Teams across different locations can collaborate seamlessly, improving development speed and efficiency.

-

Automatic Updates: Cloud service providers continuously update security patches and features, ensuring your app stays current and secure.

-

Performance Monitoring: Advanced analytics and dashboards provide insights into transaction trends, user behavior, and app performance metrics.

-

Scalable Storage: Cloud environments offer virtually unlimited data storage, which is vital for maintaining user histories, payment records, and audit logs.

The Role of an eWallet App Development Company

Partnering with an experienced ewallet app development company ensures your project fully leverages cloud technology’s potential. These companies specialize in creating scalable, high-performance payment systems that meet global standards. From infrastructure design to cloud integration, professional developers streamline deployment while minimizing operational risks.

In addition, hiring experts for ewallet app development services gives businesses access to DevOps automation, containerization (using tools like Docker and Kubernetes), and continuous integration pipelines. These modern development practices ensure that your app scales efficiently as demand grows, without performance lags or downtime.

Implementing a Cloud-Ready eWallet App Development Solution

To build a future-proof eWallet, businesses should adopt a cloud-based ewallet app development solution that integrates seamlessly with banking APIs, payment gateways, and third-party systems. Such solutions empower organizations to:

-

Scale horizontally (adding more servers as user demand grows)

-

Leverage microservices architecture for flexible upgrades

-

Ensure continuous uptime through load balancing and automated failover

-

Support advanced analytics and AI-based fraud detection

These scalable architectures not only enhance performance but also deliver long-term cost benefits by optimizing server usage and reducing maintenance complexity.

The Power of Customization in Cloud-Based eWallets

Every business has unique payment workflows, customer preferences, and compliance needs. Hence, custom ewallet app development plays a critical role in creating tailored, cloud-ready solutions. Through customization, companies can integrate loyalty programs, biometric authentication, cryptocurrency support, or region-specific payment methods—without compromising scalability.

Cloud technology supports this customization by enabling modular architecture. Developers can add, update, or remove components independently, ensuring uninterrupted performance even during upgrades or feature rollouts.

Conclusion

As the global digital payment landscape continues to expand, cloud computing stands as the backbone of scalable, efficient, and secure eWallet systems. It empowers businesses to grow without limits, handle massive transaction volumes, and deliver seamless payment experiences.

By collaborating with a leading ewallet app development company offering specialized ewallet app development services, organizations can unlock the full potential of cloud-driven innovation. Whether through a robust ewallet app development solution or custom ewallet app development, the integration of cloud technology ensures that your platform remains future-ready—capable of evolving with the ever-changing demands of modern fintech users.