In Brief:

- Former President Trump continues pushing the Federal Reserve to lower interest rates, calling it essential for economic strength.

- Fed Chair Jerome Powell holds firm, resisting political pressure amid inflation concerns.

- The crypto market surges independently, fueled by bullish narratives like tech growth and global trade progress.

- Bitcoin surpasses $105,000, showing strong investor confidence despite no rate cuts.

As the U.S. economy navigates post-pandemic recovery and persistent inflation, former President Donald Trump has renewed his campaign to pressure the Federal Reserve into cutting interest rates. Trump insists that rate cuts are critical for boosting American economic performance and maintaining a competitive edge globally.

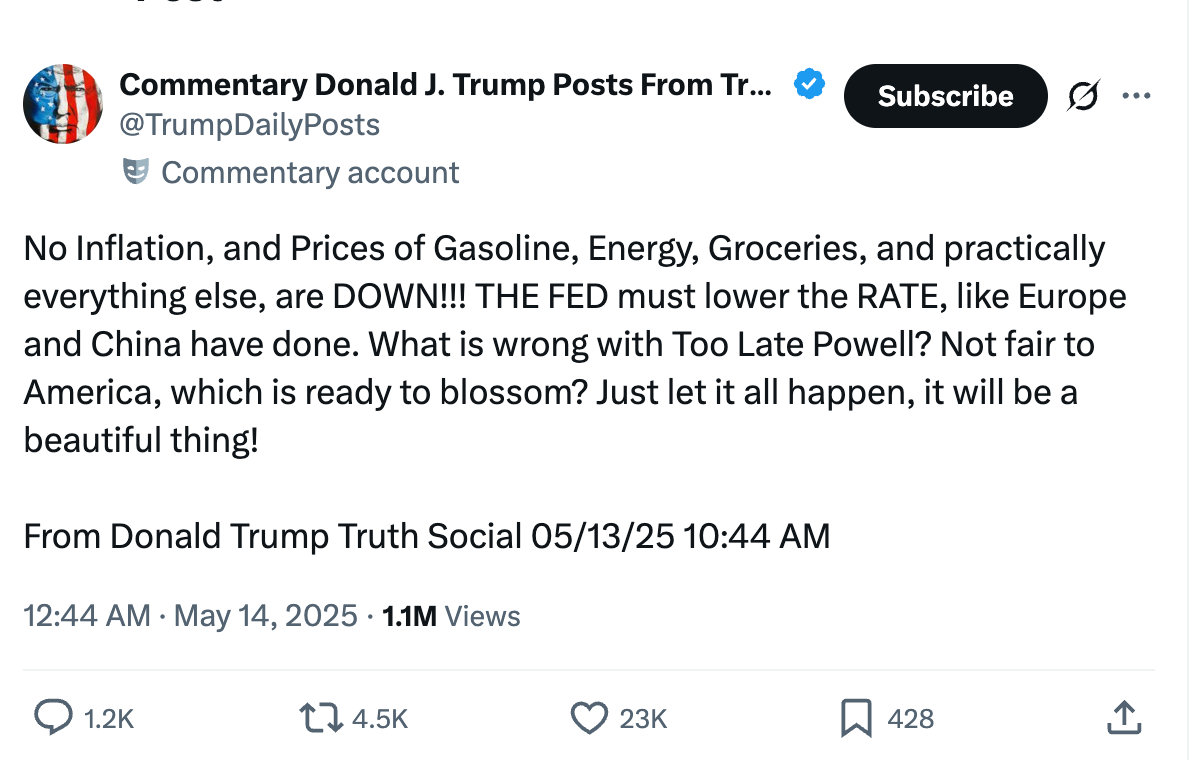

Trump Keeps Pushing for Rate Cuts

Throughout his political career — and once again on the 2024 campaign trail — Trump has made interest rate policy a central theme. In recent interviews and speeches, he has argued that the current high interest rates are stifling business growth and consumer spending. According to Trump, the Fed is acting “too cautiously,” and a more aggressive reduction in rates would jumpstart the U.S. economy and ward off potential recessionary pressures.

His calls echo those made during his presidency, when he frequently criticized the Fed for raising rates despite strong economic data. Trump’s current rhetoric is aimed at increasing pressure on Fed Chair Jerome Powell, whom he appointed in 2018, but who has since made clear that the central bank remains independent of political influence.

Despite mounting political commentary, Powell has shown no signs of caving to Trump’s demands. Citing ongoing inflation risks, labor market tightness, and a focus on long-term economic health, Powell has emphasized the importance of data-driven policy. His stance is supported by many within the Fed, who warn that cutting rates too soon could reignite inflation and undermine economic stability.

The result: a stalemate. Trump continues to demand easier monetary policy, while the Fed stays the course with its cautious, steady approach.

A Market Untethered from Fed Policy

Interestingly, the crypto market is not waiting for the Fed to act. Unlike in previous years — when traders hung on every Fed meeting for signs of rate relief — 2025 has seen a noticeable shift in how the digital asset market reacts to macroeconomic policy.

Bitcoin has broken through the $105,000 mark, setting new all-time highs. But this momentum isn’t tied to a dovish Fed or hints of easing. Instead, it’s being driven by other macro and sector-specific trends: the rollout of spot Bitcoin ETFs, rapid advancements in blockchain infrastructure, increasing adoption of decentralized finance (DeFi), and improved geopolitical sentiment, particularly around U.S.-China trade.

Institutional Confidence and Retail FOMO

With major financial institutions like BlackRock, Fidelity, and JPMorgan deepening their crypto exposure, confidence in the sector has grown. Spot Bitcoin and Ethereum ETFs have attracted billions in capital inflows, while blockchain integration in traditional finance has reached new levels.

Retail investors are following closely behind, with Google search interest in Bitcoin surging and new wallet creation hitting post-2021 highs. The broader altcoin market is also benefiting, with Ethereum surpassing $6,000 and projects like Solana, Chainlink, and Avalanche seeing double-digit gains.

A Mature Market Mindset

Perhaps the most significant development is how the crypto market has matured in its response to external pressure. Instead of relying on central bank cues, the market is now more focused on real-world utility, institutional growth, and long-term adoption trends.

Trump’s call for rate cuts might still influence traditional markets, but crypto appears to be writing its own narrative — one that isn’t as reactive to monetary policy as in the past.

Conclusion

Donald Trump’s continued push for interest rate cuts adds political drama to the economic conversation, but it’s clear the crypto market is moving forward regardless. With Bitcoin above $105,000, investor sentiment strong, and innovation accelerating, the digital asset space is increasingly driven by its own fundamentals.

The Fed may resist rate cuts, and political pressure may persist — but crypto isn’t waiting around. A new era of independence, maturity, and growth may already be underway.