Brazil’s stock exchange operator B3 has gone live with futures contracts on Ethereum (ETH) and Solana (SOL), the first alt‑coin derivatives ever listed on the bourse. The new products are dollar‑denominated, cash‑settled and expire on the last Friday of every month, giving offshore hedge funds, asset managers, and market‑makers a regulated way to take directional bets or hedge exposures to two of the world’s most actively traded smart contract platforms.

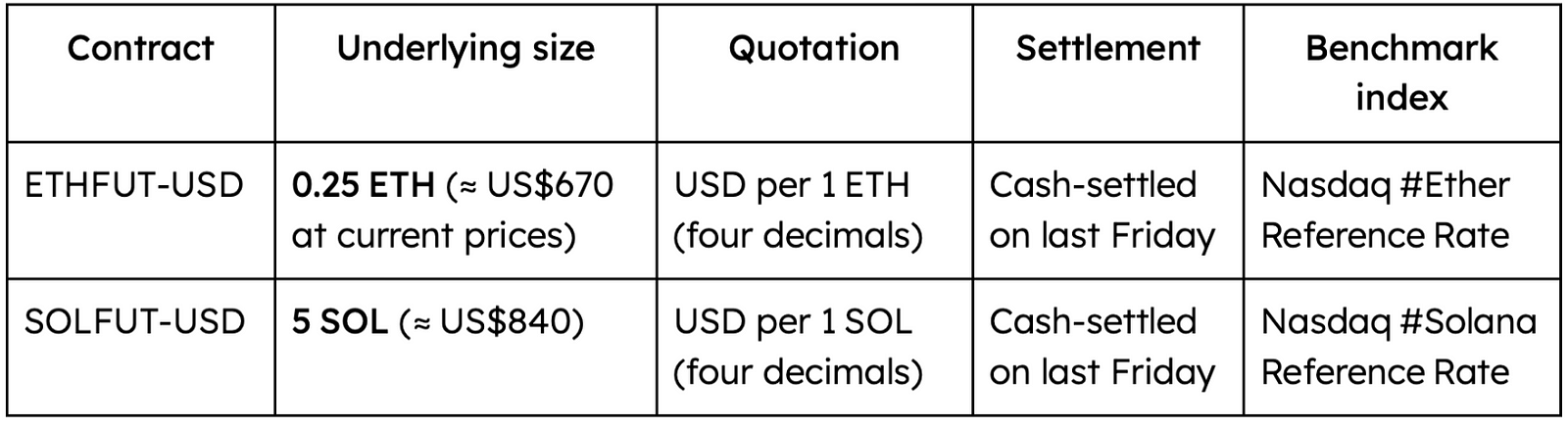

Contract specs: small notional sizes, Nasdaq benchmarks, monthly settlement

B3 chose small contract sizes “to lower the capital bar for diversification and arbitrage strategies,” said Marcos Skistymas, B3’s product director, in a statement. “Investors familiar with blockchain technology now have more sophisticated tools in a regulated, secure environment.”

The exchange already clears nine crypto ETFs and last year debuted a real‑denominated Bitcoin (BTC) futures contract. By listing the new alt‑coin futures in dollars, B3 is deliberately targeting international desks that already clear USD‑settled crypto derivatives on CME or Binance but want Latin America trading hours and local clearing netting offsets.

Why USD‑denominated?

- FX neutrality for global funds. Most of the world’s ETH and SOL liquidity is still quoted in dollars. Trading in USD avoids embedded BRL currency risk.

- Cross‑margin with offshore books. Clearing in dollars lets prop shops and hedge funds net exposures across global venues, reducing capital costs.

- Expedited approvals. Brazil’s securities watchdog CVM cleared the products in May, noting that the contracts do not require physical delivery of the tokens — a key concern for anti‑money‑laundering compliance.

Market impact: arbitrage, hedging, and Brazil’s crypto trajectory

- Arbitrage and basis trading. The ETH and SOL futures create a fresh basis between B3, CME’s cash‑settled offerings and perpetual swaps on offshore exchanges. Quant desks can arbitrage price gaps, boosting volumes on all venues.

- Structured products for wealth managers. Brazilian private banks that already wrap CME BTC futures in structured notes can now offer ETH and SOL‑linked certificates without currency overlays.

- Broader regulatory embrace. CVM has gradually green‑lit a full crypto ETF shelf, a spot XRP ETF earlier this year, and now multi‑asset futures. Analysts say Brazil is positioning itself as LatAm’s most mature regulated crypto derivatives hub, competing with the CME in Chicago and SGX in Singapore.

What comes next?

- More alt‑coins. B3 officials have hinted that Cardano (ADA) and Polygon (MATIC) are under review if liquidity thresholds are met.

- Options layer. Exchange insiders say listed options on BTC, ETH and SOL could follow in early 2026, mirroring the path CME took after launching its micro futures.

- Cross‑listing and partnerships. The exchange has explored cross‑margin agreements with SGX — which is working with B3 on Brazilian real futures — to give Asian desks seamless collateral recycling.

Conclusion

By launching USD‑backed Ethereum and Solana futures and resizing its Bitcoin contract for retail, B3 is threading the needle between global institutional demand and domestic retail enthusiasm. The dual‑track strategy could cement São Paulo’s status as a key crypto‑derivatives hub — just as Brazil’s broader capital‑markets reforms attract a new wave of foreign inflows.

Whether the liquidity follows will depend on arbitrage efficiency, tax treatment, and continued regulatory clarity. But for now, traders on both Ipanema beach and Wall Street have a new regulated playground to express their crypto views — under the watchful eye of South America’s biggest exchange.