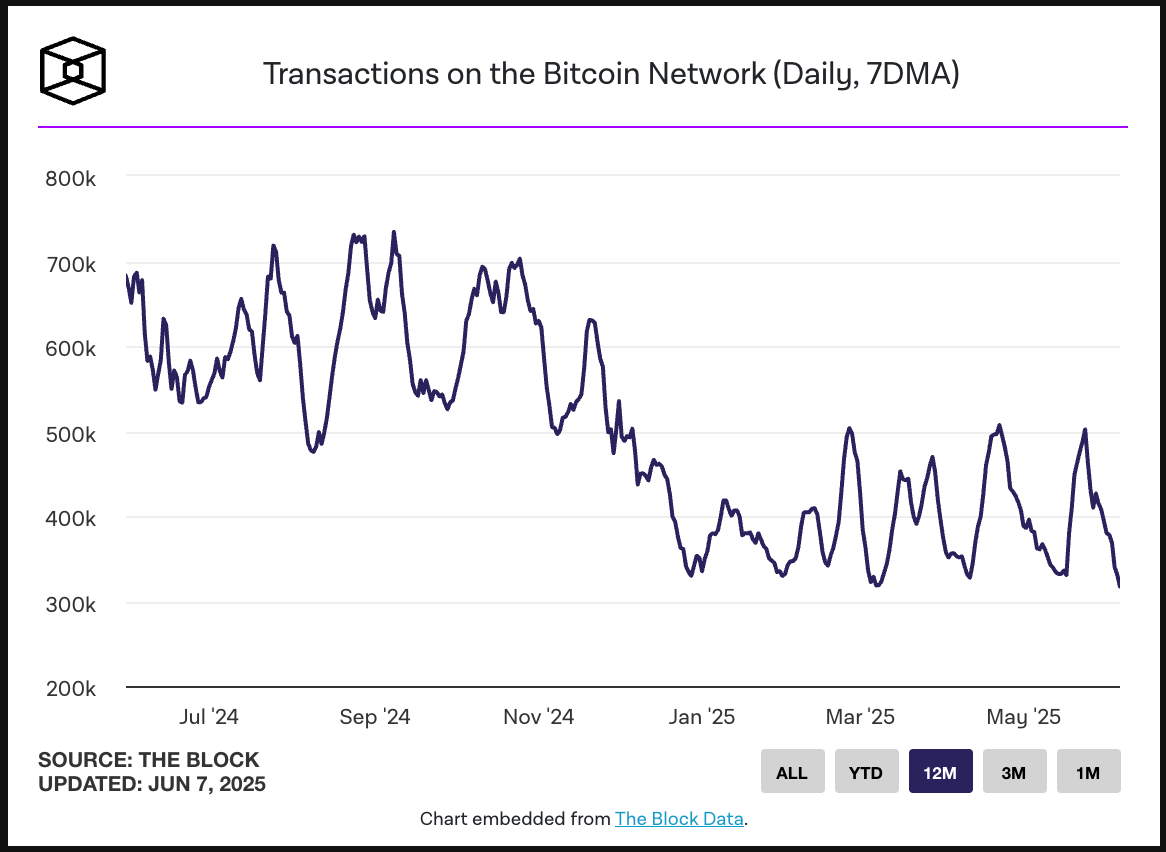

Bitcoin, the world’s most prominent cryptocurrency, is experiencing a marked slowdown in on-chain activity. The seven-day moving average of transactions on the Bitcoin network has plummeted to levels not seen since October 2023 — marking a 19-month low in usage.

This decline in transaction volume raises significant questions about the current state of the network and user demand. Analysts point to a mix of market uncertainty, fee economics, and changing user behavior as likely contributors.

A Warning Sign — Or a Healthy Adjustment?

The slowdown comes amid broader quietude in crypto markets, as Bitcoin’s price has remained relatively stable after a turbulent period of volatility earlier in the year. Fewer transactions could reflect a cooling-off phase, where users are holding rather than trading, possibly anticipating future market moves or simply taking a step back.

However, some see the drop as a warning sign that miner incentives and user priorities may be misaligned. Low-fee or non-standard transactions, which previously might have been deprioritized, are now making their way into blocks with greater ease.

Developers Call for Inclusion of Low-Fee Transactions

On Friday, several Bitcoin Core developers released a joint statement emphasizing that network nodes should not refuse to relay low-fee or non-standard transactions — provided miners are willing to include them. This statement hints at a broader consensus within the development community: that Bitcoin should remain open and accessible, especially during periods of low activity.

Their message appears to advocate for a more inclusive network posture, encouraging the acceptance of transactions regardless of fee levels, as long as miners are willing to validate them.

A Telling Signal From the Mempool

Mononaut, the founder of the open-source Bitcoin explorer Mempool, observed a particularly telling event: a transaction with a near-zero fee was recently confirmed into a block. This occurrence, though rare in times of high demand, underscores the current lull in network activity and the relatively open capacity among miners.

“In high-demand conditions, that transaction would’ve sat unconfirmed for hours — if not days,” Mononaut noted. “Its inclusion points to one thing: there’s just not much else competing for space.”

What’s Next for Bitcoin Activity?

This dip in transaction activity doesn’t necessarily spell trouble for Bitcoin, but it does serve as a critical moment of reflection. With second-layer solutions like the Lightning Network continuing to grow, and alternative blockchains offering cheaper and faster options for smaller transactions, Bitcoin may be settling more into its role as a long-term store of value — rather than an everyday medium of exchange.

Still, the recent developer push for broader transaction inclusion could help keep the network accessible, especially for those experimenting with Bitcoin in unconventional ways or operating on tight margins.

For now, the network remains healthy, secure, and underutilized — a rare moment of calm in the often-chaotic world of crypto.