The Employee’s State Insurance Corporation (ESIC) is a crucial government body in India, providing medical, financial, and other benefits to employees across various industries. Recent updates to the ESIC payment processes in 2025 aim to streamline contributions and enhance convenience for both employees and employers. These changes are expected to improve transparency, simplify payment procedures, and extend benefits to a larger number of beneficiaries under the Employee’s State Insurance scheme.

This article explores the recent modifications in ESIC payment processes, their impact on employees, and the overall benefits that these changes bring to the system.

Overview of the Employee’s State Insurance scheme

The Employee’s State Insurance scheme is a social security initiative that provides financial and healthcare benefits to workers. It covers medical expenses, compensation during illnesses, maternity benefits, and financial support for workplace injuries. Employees and their dependents can avail themselves of these services through contributions made by both employees and employers.

The scheme ensures a safety net for workers, reducing the financial stress caused by medical emergencies and work-related risks. Regular ESIC payments fund these benefits, making it a vital program for employees, especially in industries prone to workplace hazards.

Key changes in ESIC payment processes in 2025

In 2025, several improvements were introduced to the ESIC payment processes, designed to enhance accessibility and efficiency:

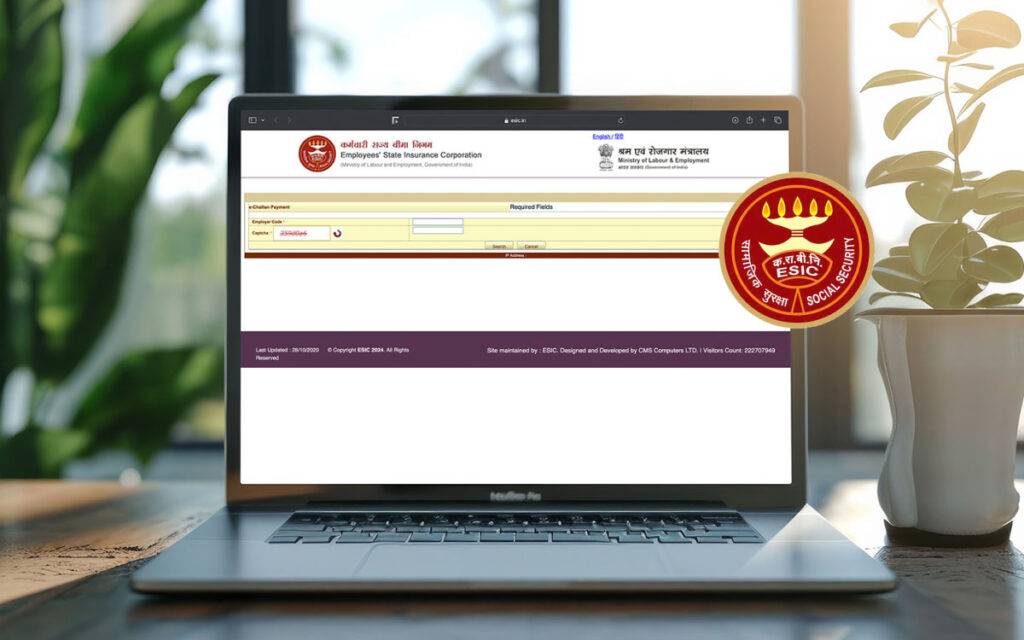

- Online payment options: The most notable update is the full integration of online ESIC payment methods, allowing employees and employers to make contributions through digital platforms. This change reduces the dependency on physical paperwork and makes the payment process quicker and more reliable.

- Automated reminders and notifications: The ESIC system now includes automated reminders for upcoming contributions. These reminders help employers ensure timely ESIC payments, preventing penalties for late payments and maintaining uninterrupted benefits for employees.

- Simplified registration for new employees: With streamlined digital registration, new employees are enrolled in the Employee’s State Insurance scheme more efficiently. This reduces the time lag in accessing benefits and keeps employees covered from the moment they join.

- Transparent contribution tracking: Enhanced tracking features allow employees to view their ESIC payment history and confirm that contributions are up-to-date. This transparency builds trust and enables employees to stay informed about their contributions.

- Improved customer support: The ESIC has introduced dedicated online support to assist with ESIC payment inquiries. This support service helps resolve issues quickly, ensuring that employees and employers can make and verify payments without complications.

Benefits of the new ESIC payment processes

The recent changes to ESIC payment processes have introduced several benefits for employees and employers alike. Here are some of the key advantages:

- Enhanced convenience: With online payment options, both employees and employers can make ESIC payments from anywhere. This flexibility is especially beneficial for companies with remote or multi-location setups, where physical payment submissions are challenging.

- Timely contributions: Automated reminders and digital payment options make it easier for employers to meet payment deadlines. Timely ESIC payments ensure that employees continue to receive benefits without any interruptions, enhancing the reliability of the Employee’s State Insurance scheme.

- Transparency and accessibility: The ability to track ESIC payment history offers employees a clearer view of their contributions. This transparency fosters trust and provides employees with confidence in the benefits they are entitled to under the Employee’s State Insurance scheme.

- Faster access to benefits: With streamlined registration, new employees gain faster access to Employee’s State Insurance benefits. Quick enrolment ensures that employees are protected from day one, reducing the risks associated with delayed coverage.

- Reduced administrative burden: The digitalisation of ESIC payment processes reduces paperwork and manual intervention, saving time and resources for both employees and employers. This efficiency is particularly beneficial for businesses with high employee turnover, where frequent registrations are required.

How the changes impact employees and employers

The recent improvements to ESIC payment processes directly impact both employees and employers, enhancing the overall effectiveness of the Employee’s State Insurance scheme.

- For employees: The updated processes make it easier for employees to track their contributions and stay informed about their coverage status. Knowing that ESIC payments are up-to-date gives employees peace of mind, especially during medical emergencies. Additionally, quicker access to benefits ensures they receive necessary support without unnecessary delays.

- For employers: The simplified digital processes reduce the administrative workload, making it easier for employers to comply with Employee’s State Insurance requirements. Automated reminders help employers avoid late fees, ensuring they remain compliant while securing uninterrupted benefits for their workforce.

Future outlook for ESIC payments

The changes introduced in 2025 represent a significant step forward for the ESIC payment system. As digitalisation in government services continues to progress, the Employee’s State Insurance scheme may see further enhancements to improve efficiency and accessibility. Potential future updates could include:

- Integration with mobile apps: Making ESIC payment options available through mobile applications could further improve accessibility, especially for employees who prefer managing contributions on their smartphones.

- Enhanced data security: As digital platforms handle sensitive data, improved cybersecurity measures will be essential to protect employee information and ensure secure ESIC payments.

- Expansion of customer support channels: Providing multilingual support or expanding customer service hours could make it even easier for employees to resolve ESIC payment issues and inquiries.

Conclusion

The recent changes to ESIC payment processes in 2025 have brought considerable benefits for employees and employers alike. By moving towards a fully digital payment system, the Employee’s State Insurance scheme has become more accessible, transparent, and efficient. Employees now have better access to their benefits, faster registration, and improved visibility over their contributions, while employers benefit from reduced administrative tasks and timely contribution reminders.

As the system continues to evolve, further enhancements to the ESIC payment processes are likely, driven by digital innovation and a commitment to improving employee welfare. The Employee’s State Insurance scheme stands as a critical component of social security in India, providing much-needed support and security to the nation’s workforce.