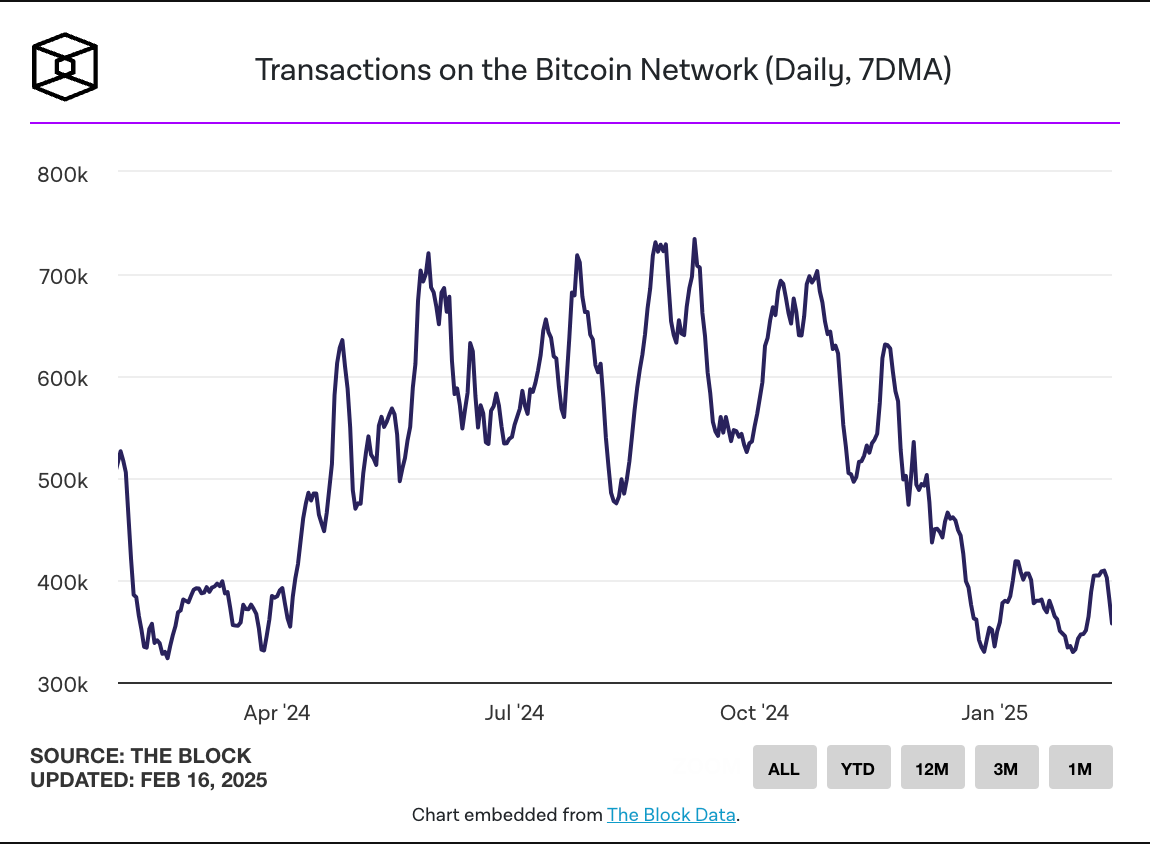

Bitcoin, the world’s leading cryptocurrency, has been experiencing a significant slowdown in its network activity, with the latest data revealing a sharp decline in transaction volumes. The 7-day moving average of Bitcoin network transactions has fallen to 330,000, representing a 55% drop from its peak of 730,000 transactions, observed earlier in the network’s history. This marks a 12-month low, indicating a notable shift in how the Bitcoin network is being utilized.

A Decline in Transaction Volumes

Bitcoin’s network activity typically reflects the demand for its blockchain in terms of transactions, usage, and adoption. The recent decline in transaction volumes suggests that fewer people are actively using the Bitcoin network for transferring funds, conducting business, or engaging with Bitcoin-based protocols.

The drop of 55% from the peak could be indicative of several factors at play, including market sentiment, the broader economic environment, and the evolving role of Bitcoin within the cryptocurrency ecosystem. Despite Bitcoin’s enduring reputation as a store of value, the drop in network activity suggests that it may be taking a backseat in the short term compared to more actively used blockchain networks.

One of the most telling signs of reduced activity on the Bitcoin network is the stabilization of transaction fees. Over the past month, Bitcoin’s transaction fees have settled around $500,000, down significantly from the higher levels observed during periods of heightened network activity. This mirrors the decrease in overall transaction volumes, as less activity typically leads to reduced demand for block space on the blockchain, which in turn results in lower fees.

For context, transaction fees on Bitcoin had surged to unprecedented levels during the 2024 crypto boom, when both retail and institutional interest in Bitcoin was at its peak. As the network became congested with transactions, miners reaped the rewards of these high fees. However, with activity cooling down, fees have leveled off, indicating less strain on the blockchain and a potential shift in market behavior.

What Does This Mean for Bitcoin’s Future?

While the decline in network activity is significant, it’s essential to consider the broader context of Bitcoin’s long-term trajectory. Bitcoin’s primary use case as a store of value or digital gold remains intact, with many investors using it to hedge against inflation and economic uncertainty. However, the slowdown in transactional use cases and the diminishing role of protocols like Runes and Ordinals could be signaling a shift in market dynamics.

For Bitcoin to regain its earlier network activity levels, it may need to evolve beyond its current limitations. This could involve layer-2 solutions, such as Lightning Network, which aim to enhance Bitcoin’s scalability and transaction throughput, allowing the network to support more use cases without congestion or high fees.

Additionally, the broader market landscape could also influence Bitcoin’s activity. Bitcoin halving events in the future, changes in regulatory environments, and broader macroeconomic conditions will likely play a role in determining the future of Bitcoin’s network activity.

Looking Ahead: The Road to Recovery?

Despite the current lull in transaction volumes and protocol activity, Bitcoin remains the dominant force in the cryptocurrency space. The network’s security, decentralization, and inflation-resistant nature still make it a cornerstone of the blockchain industry. As the crypto market matures, it’s likely that Bitcoin will continue to find new avenues for growth, whether through institutional adoption, innovative technological developments, or expanding use cases beyond its traditional role.

As of now, the drop in transaction activity may be a sign of market consolidation rather than a fundamental issue with Bitcoin itself. The crypto ecosystem is highly cyclical, and this dip in activity may simply be part of the broader market cycle before another period of heightened interest and usage takes place.

Ultimately, the coming months and years will reveal whether Bitcoin can maintain its leadership role in the space or if newer, more efficient blockchain platforms will begin to steal its market share. For now, though, Bitcoin remains a foundational player in the evolving world of cryptocurrencies, with its future still full of potential despite the recent dip in network activity.